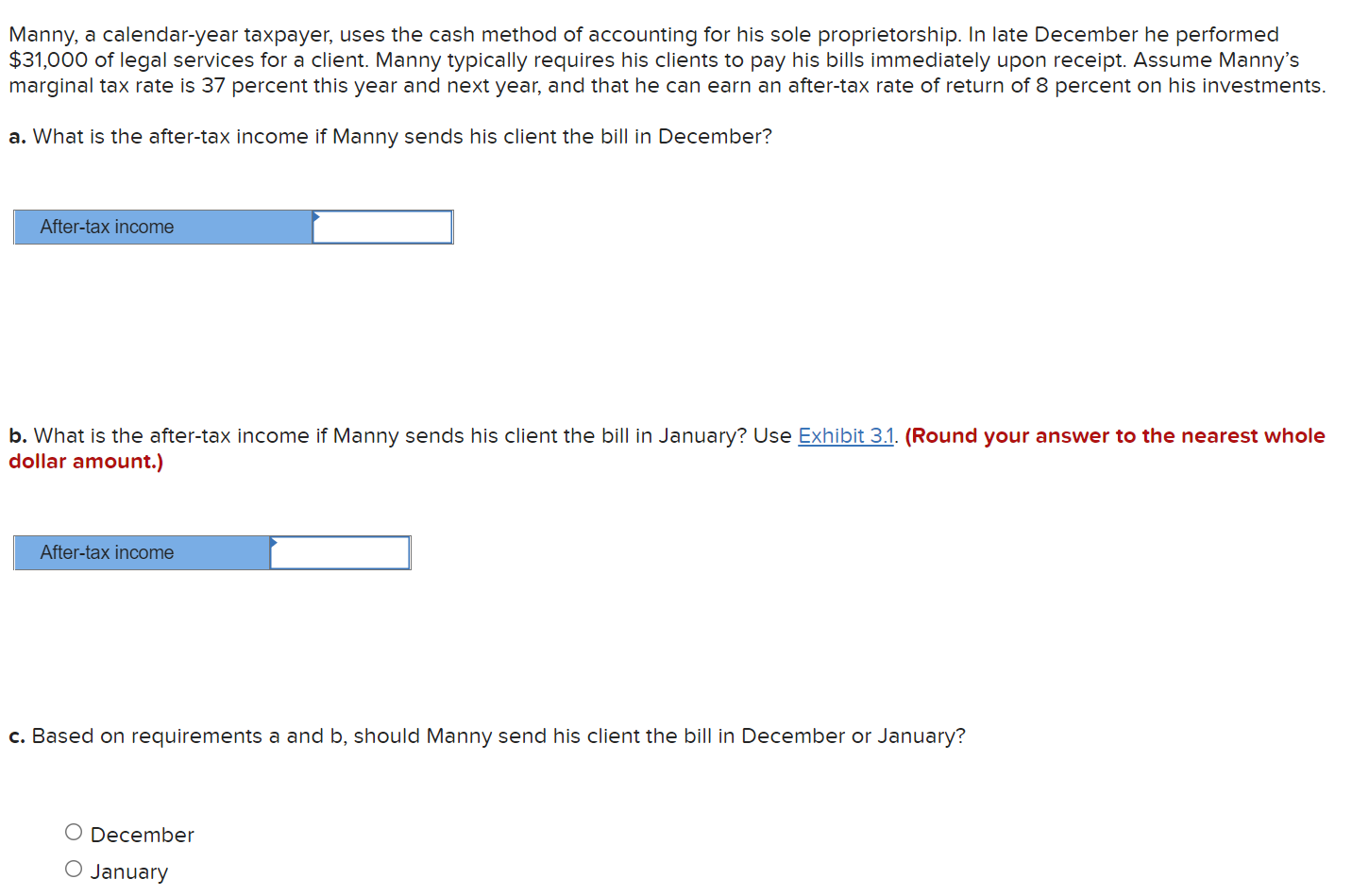

Manny A Calendar Year Taxpayer

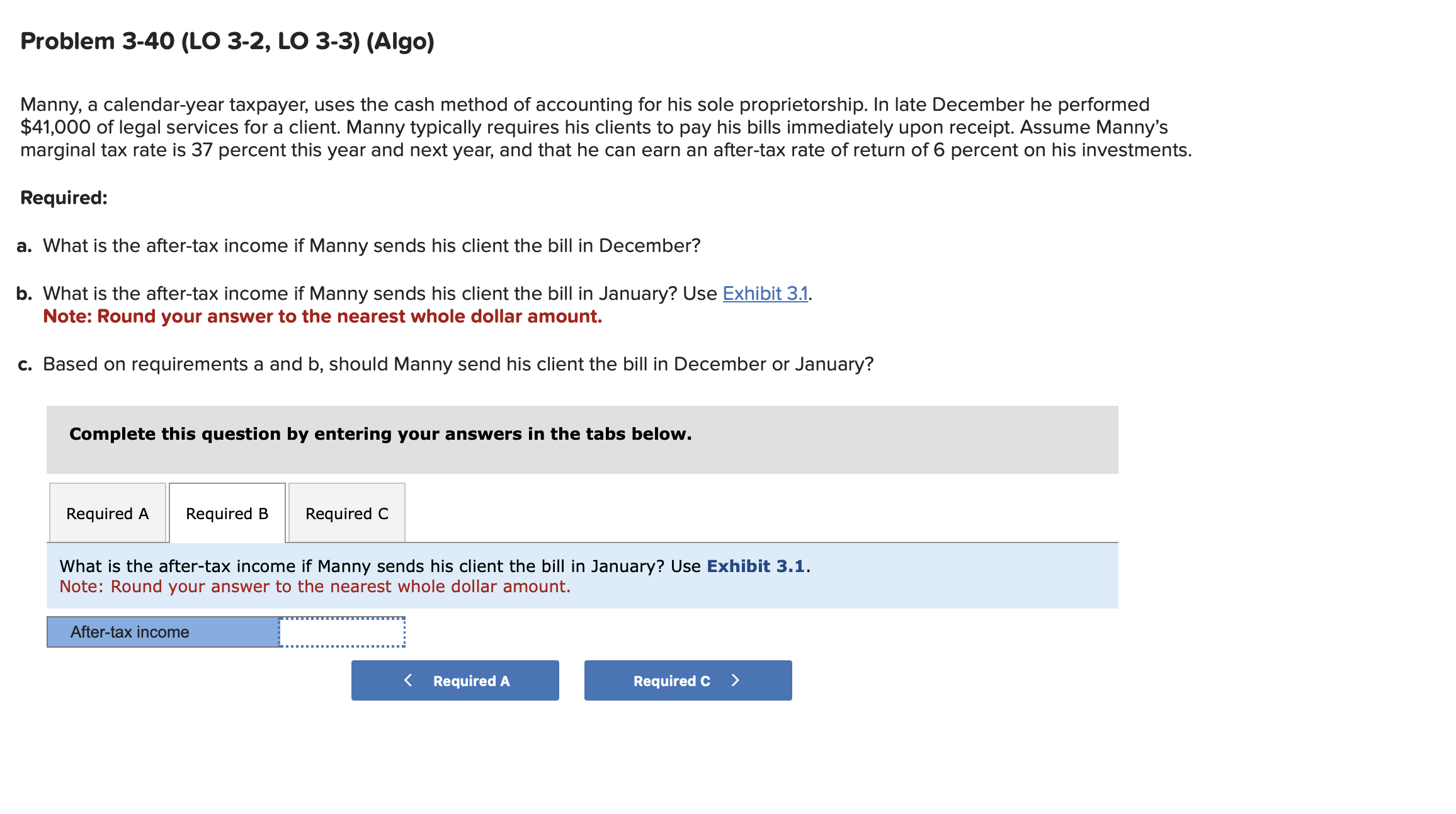

Manny A Calendar Year Taxpayer. In late december he performed. In late december he performed $22,000 of legal services for a client.

A business pays a weekly salary of 22000 dollars on a friday for a 5 day week, ending on that day, and journalize the necessary adjusting entry at the end of the. In late december he performed $14,000 of legal services for a client.

Solved Manny, a calendaryear taxpayer, uses the cash method, If manny sends the bill in december, he will include the $38,000. In late december he performed $22,000 of legal services for a client.

SOLUTION Manny a calendar year taxpayer uses Studypool, In late december he performed $14,000 of legal services for a client. In late december he performed $45,000 of legal services for a client.

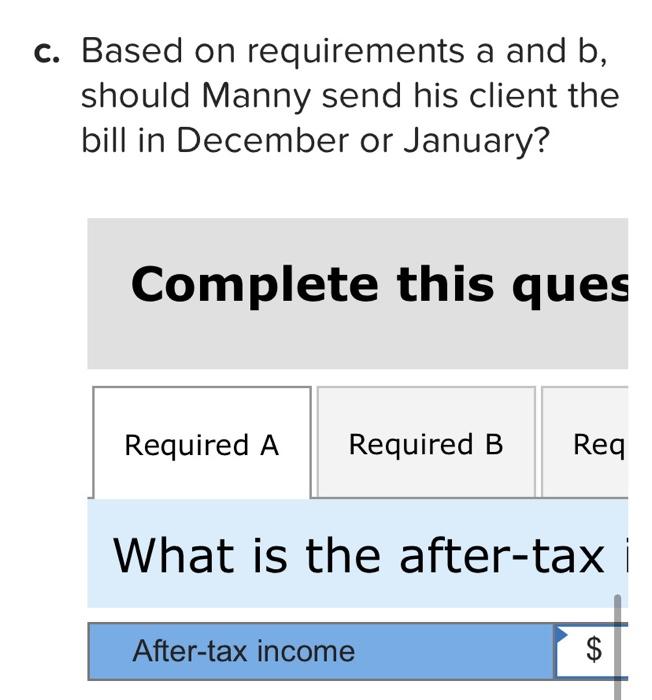

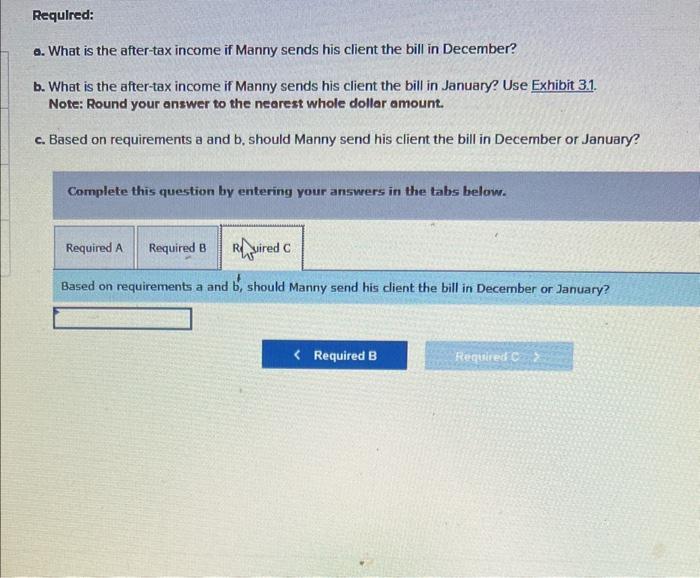

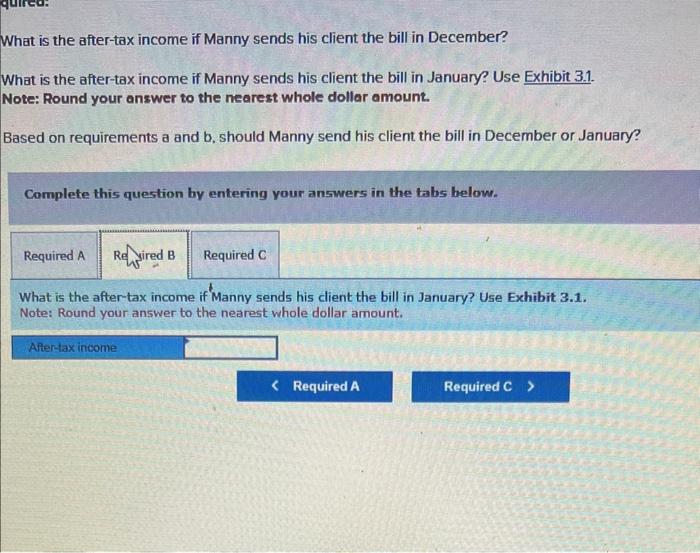

Solved Manny, a calendaryear taxpayer, uses the cash method, Should manny send his client the bill in december or january? In late december he performed.

Solved Manny, a calendaryear taxpayer, uses the cash method, In late december he performed $45,000 of legal services for a client. If manny sends the bill in december, he will include the $38,000.

Solved Manny, a calendaryear taxpayer, uses the cash method, In late december he performed $14,000 of legal services for a client. In late december he performed $27,000 of legal services for a client.

Solved Manny, a calendaryear taxpayer, uses the cash method, In late december he performed $27,000 of legal services for a client. In late december he performed $22,000 of legal services for a client.

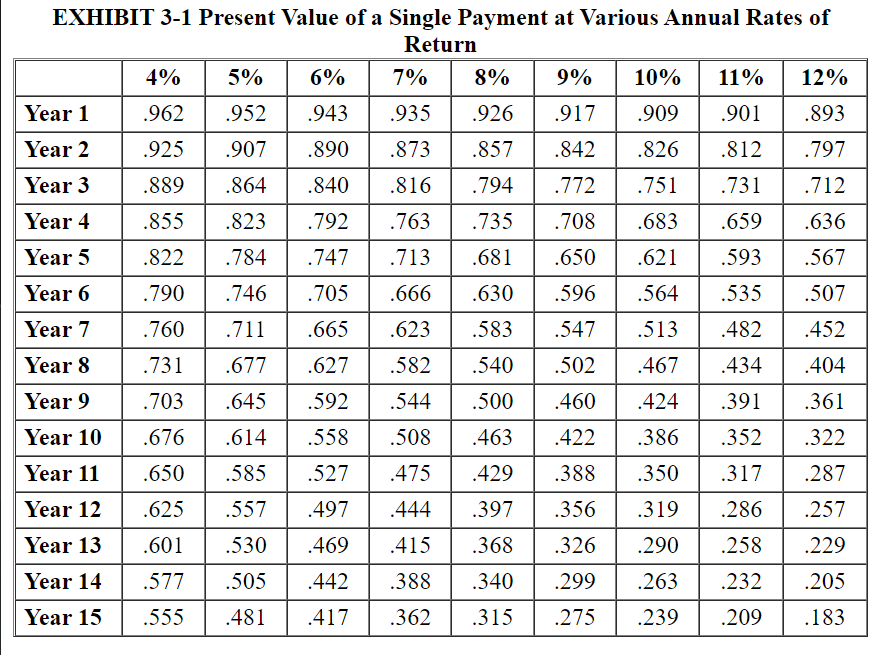

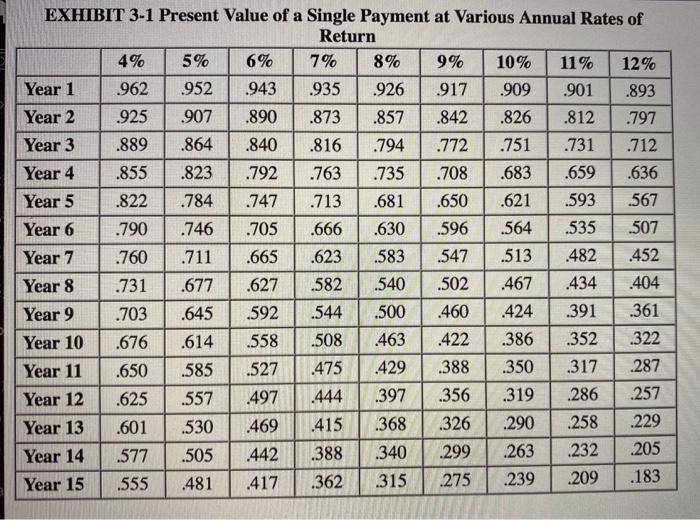

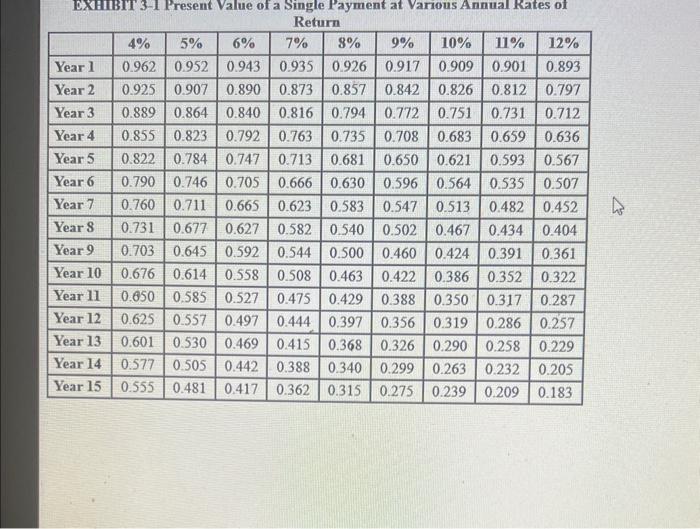

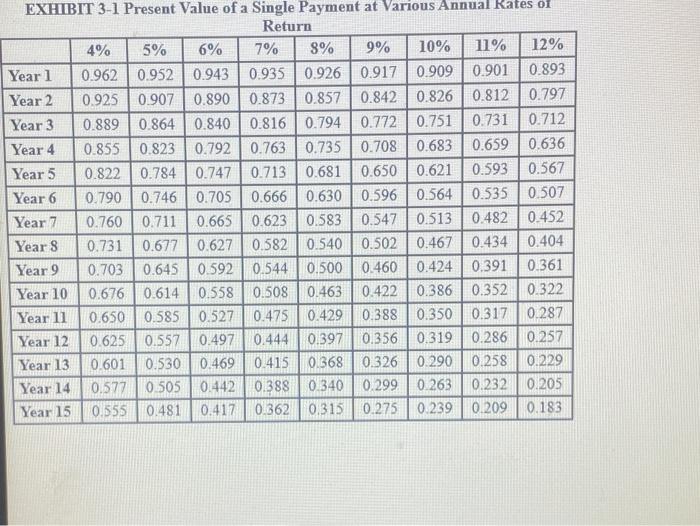

Solved Manny, a calendaryear taxpayer, uses the cash method, A business pays a weekly salary of 22000 dollars on a friday for a 5 day week, ending on that day, and journalize the necessary adjusting entry at the end of the. Assume manny's arginal tax rate is 37 percent this year and next year, and that he can earn an.

Solved Manny. a calendaryear taxpayer, uses the cash method, A business pays a weekly salary of 22000 dollars on a friday for a 5 day week, ending on that day, and journalize the necessary adjusting entry at the end of the. We have the date, then we have the account title and explanation, and then we have our.

Solved Manny. a calendaryear taxpayer, uses the cash method, We're going to create the adjusting entry and have our columns here. Answer is complete and correct.

Solved Manny, a calendaryear taxpayer, uses the cash method, Let's look at the transactions. We have the date, then we have the account title and explanation, and then we have our.